It's Saturday afternoon,

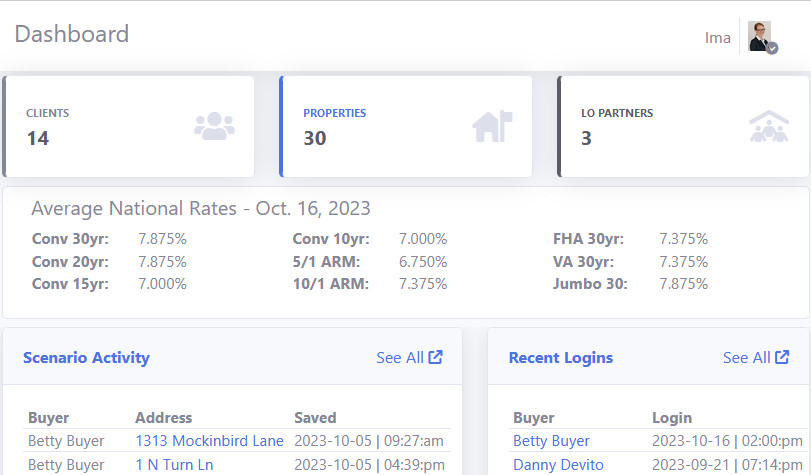

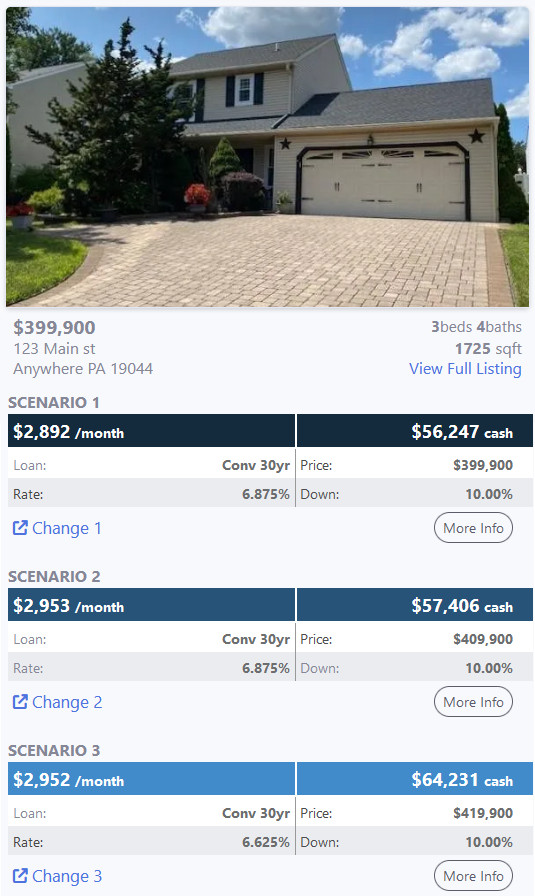

and you're showing the Jones family a home that just came on the market. This is the one. They love it and want to put in an offer. You pull out your phone, log into PropCalcs and create 3 buying options in about a minute.

AUTO IMPORT(in most cases)

You copy/paste a link from a homesearch site or use our address search tool and the property details are imported for you.

AUTO CALCULATIONS

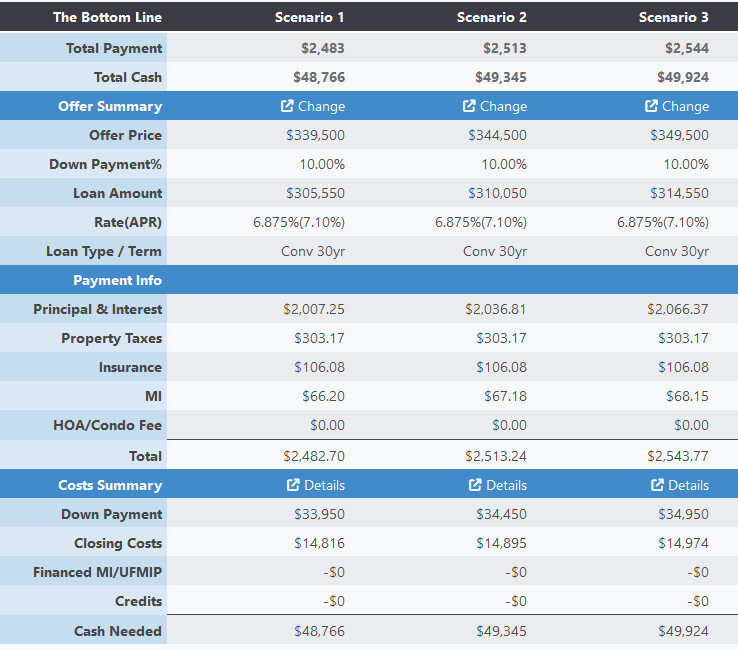

You know there will be competition so you set the autoPrice settings to add $10,000 to the asking price for scenario 2 and $20,000 for scenario 3. The different offer prices, payments & costs are automatically calculated.

CLIENT ACCESS

After logging into their own account, your buyers review the options but think the payments are a little higher than what they want to spend. You call your Lender Partner and say, "I'm at 123 Main St with the Joneses. We need to offer over the asking price but they don't like the payments. Can you take a look and give us some ideas?". Your Lender says, "Sure, give me a few mins".

LENDER PARTNERS

Your lender logs into their account and accesses the scenario you just created for your buyers. After checking the buyer's profile and current rate sheets, they update the scenario. You and the Joneses refresh the scenario page to see the new numbers.

A CHOICE IS MADE

Your lender was able to show some options with a little more cash down or a little more closing costs to lower the rate. You're all on the same page and seeing the same info in real time. Your buyer looks at the options and says, "I can do that one. Let's write this up now."

Empower Your Clients:

Show your dedication to providing exceptional service by giving your clients the ability to compare financing options in a clear, easy-to-understand format. It's about helping them make the best choice for their future home.